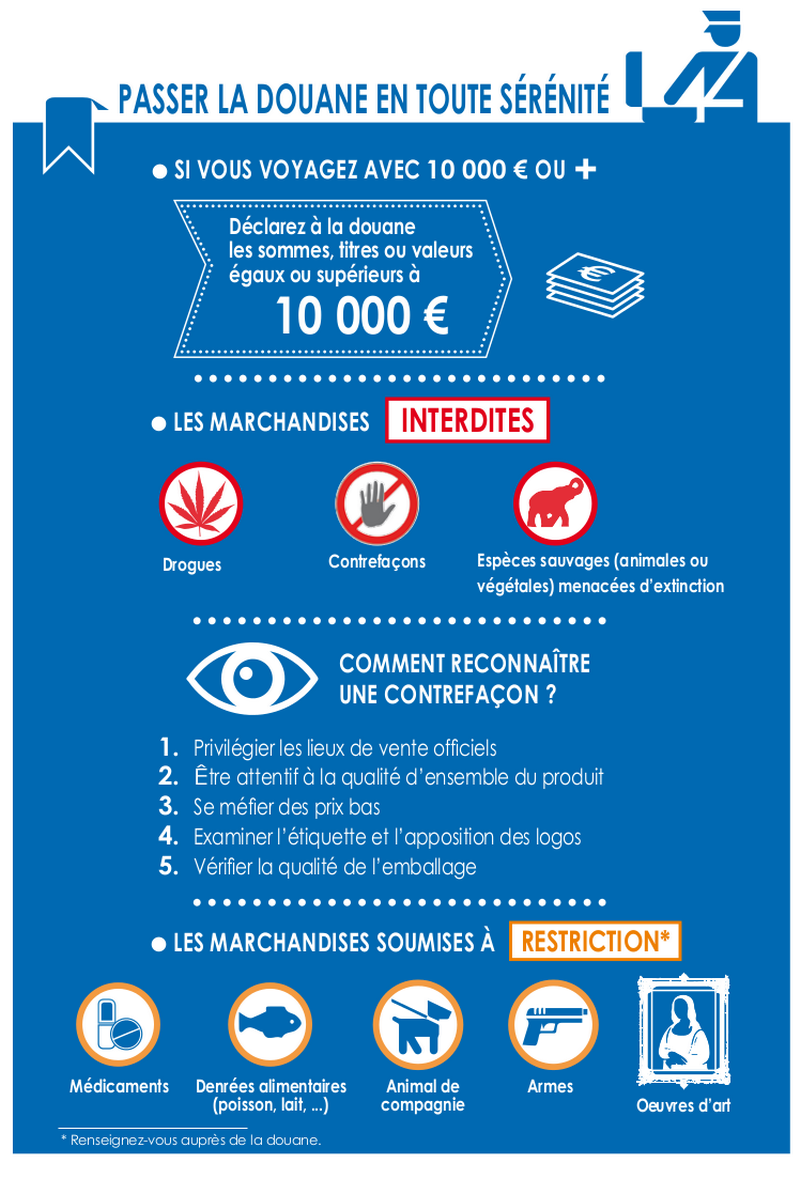

Do you pay customs duties on your purchases when you return from a trip (EU and foreigner)? | Service-Public.fr

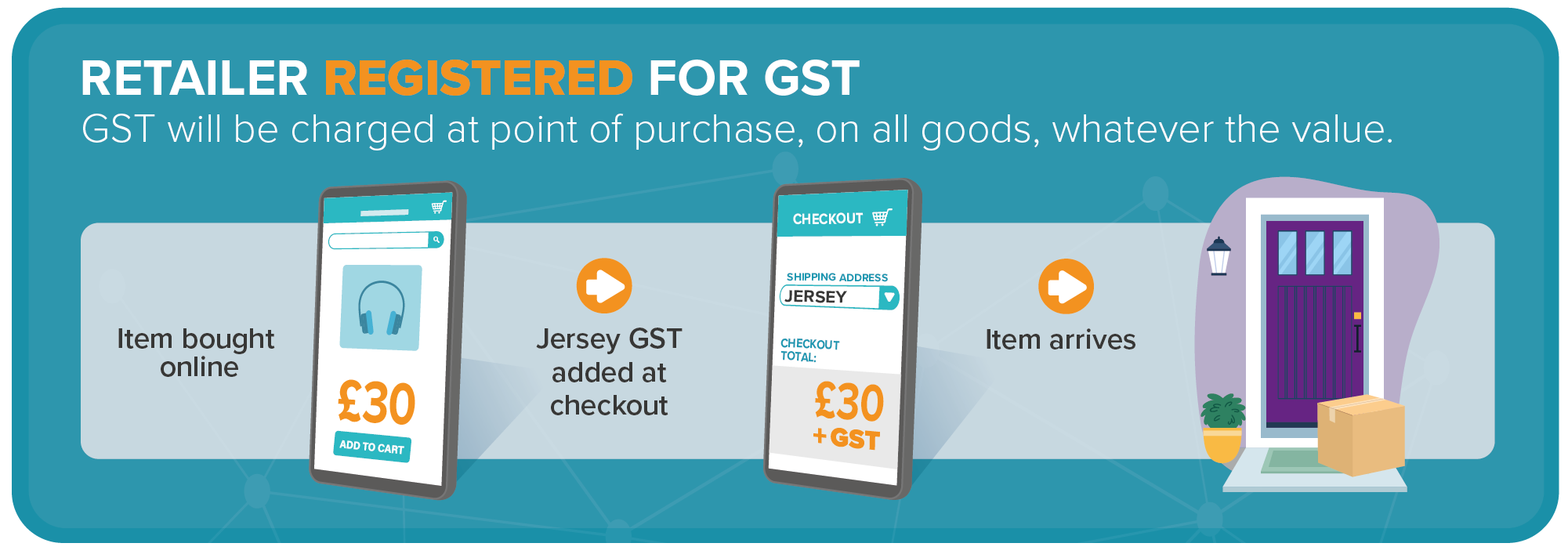

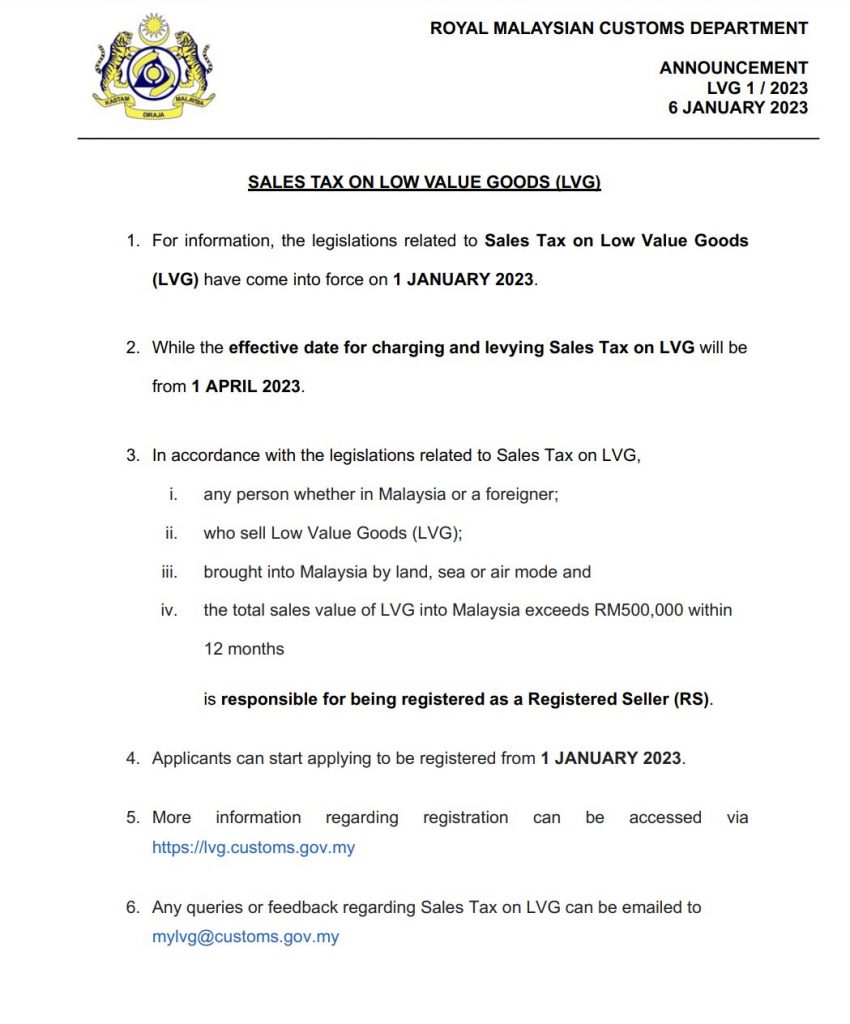

Shopee Begins Notifying Users On 10% LVG Sales Tax On Overseas Purchases Below RM500 In 2024 – Pokde.Net

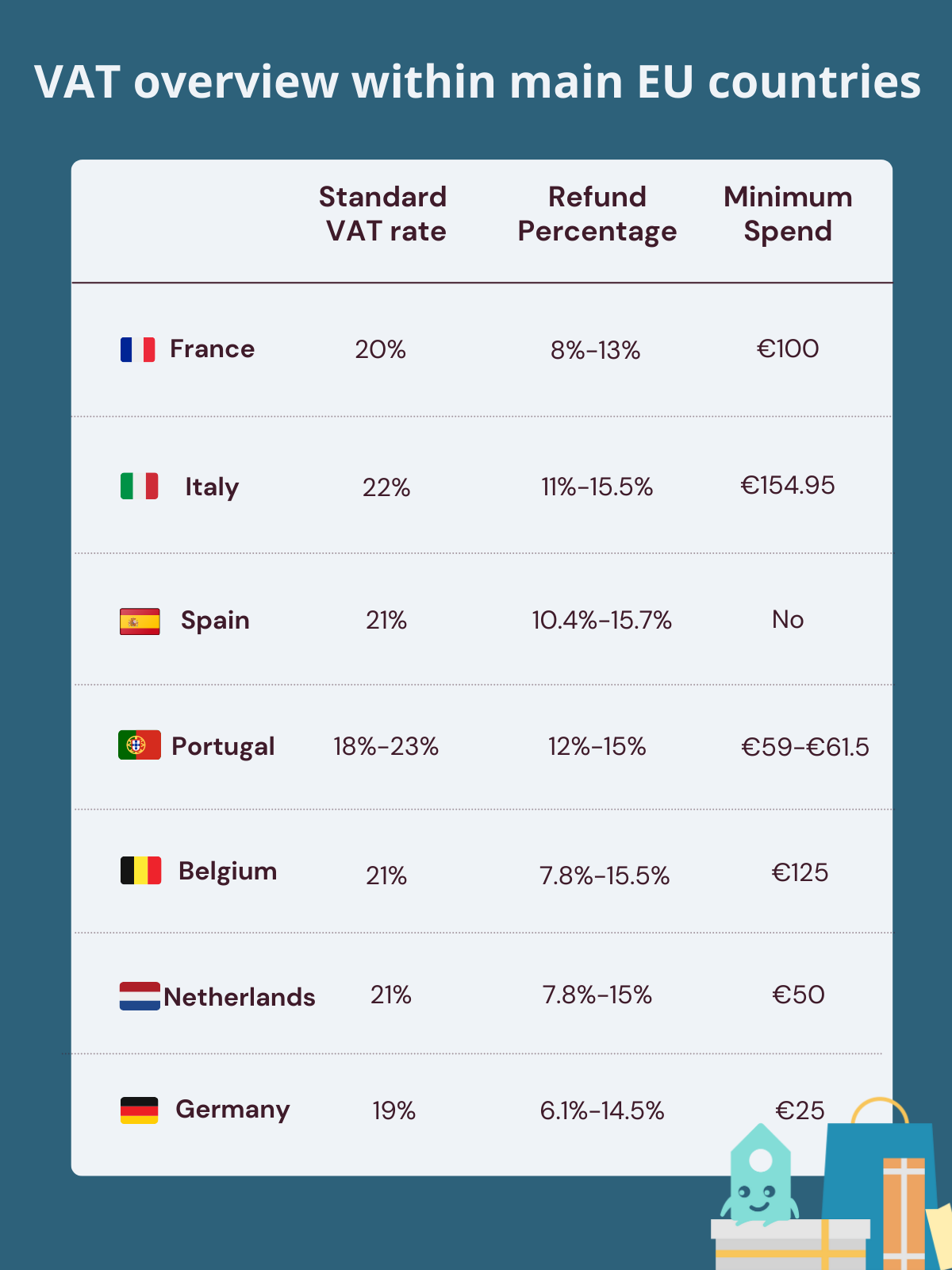

Tax free shopping: Why buying items overseas without tourist VAT refunds can lead to 'double taxation' - CNA

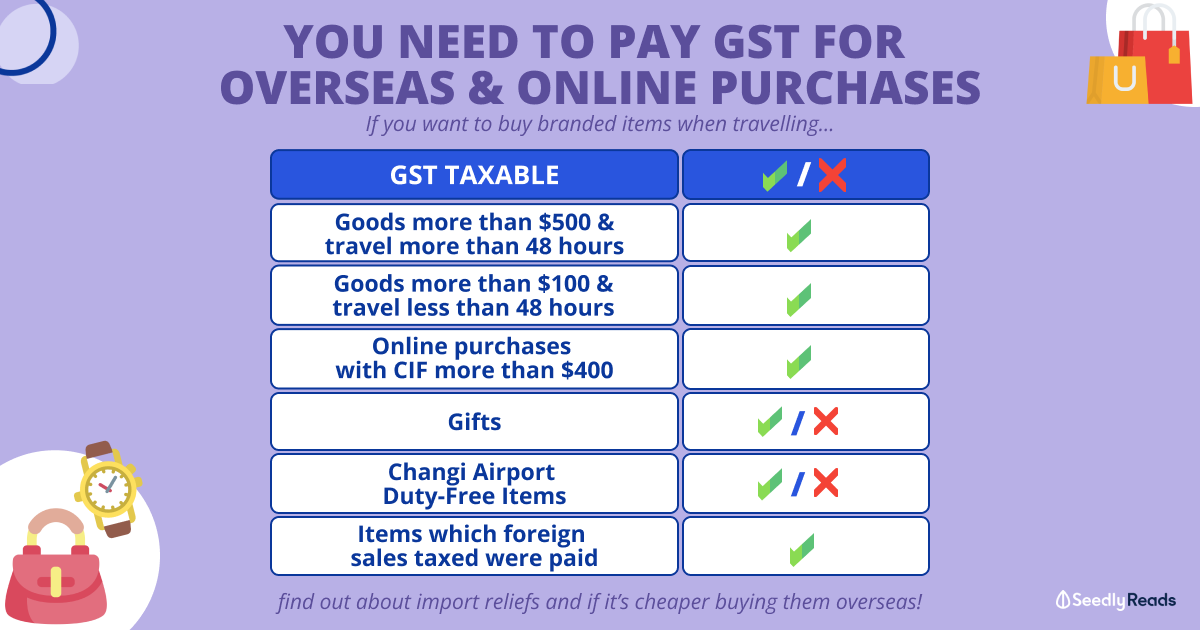

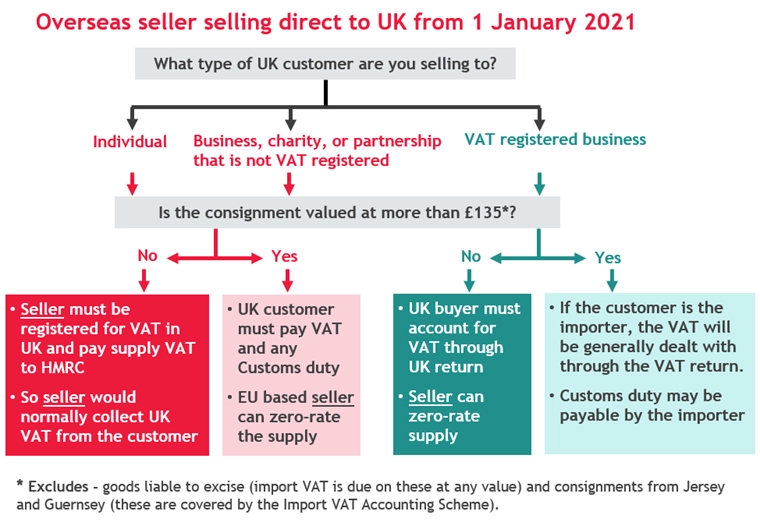

10% tax for imported online shopping goods worth below RM500 from April 2023. Here's what you need to know - SoyaCincau